In the shadow of the Boeing 737 MAX saga, the aviation industry finds itself at a critical juncture fraught with a narrative of significant incidents, software malfunctions, and a cascade of global groundings. These incidents are a stark reminder of the fragility and complexity inherent in modern aviation, compelling me to consider hypothetical yet semi-plausible scenarios within business aviation.

To be crystal clear, the below are a 100% random collection of 3-type variants, chosen because they represent an appealing cross-section of some popular models and usage personas. And, honestly, because these make types are a testament to their manufacturers and the cultures they continue to exemplify. Now, let’s get into some hypotheticals.

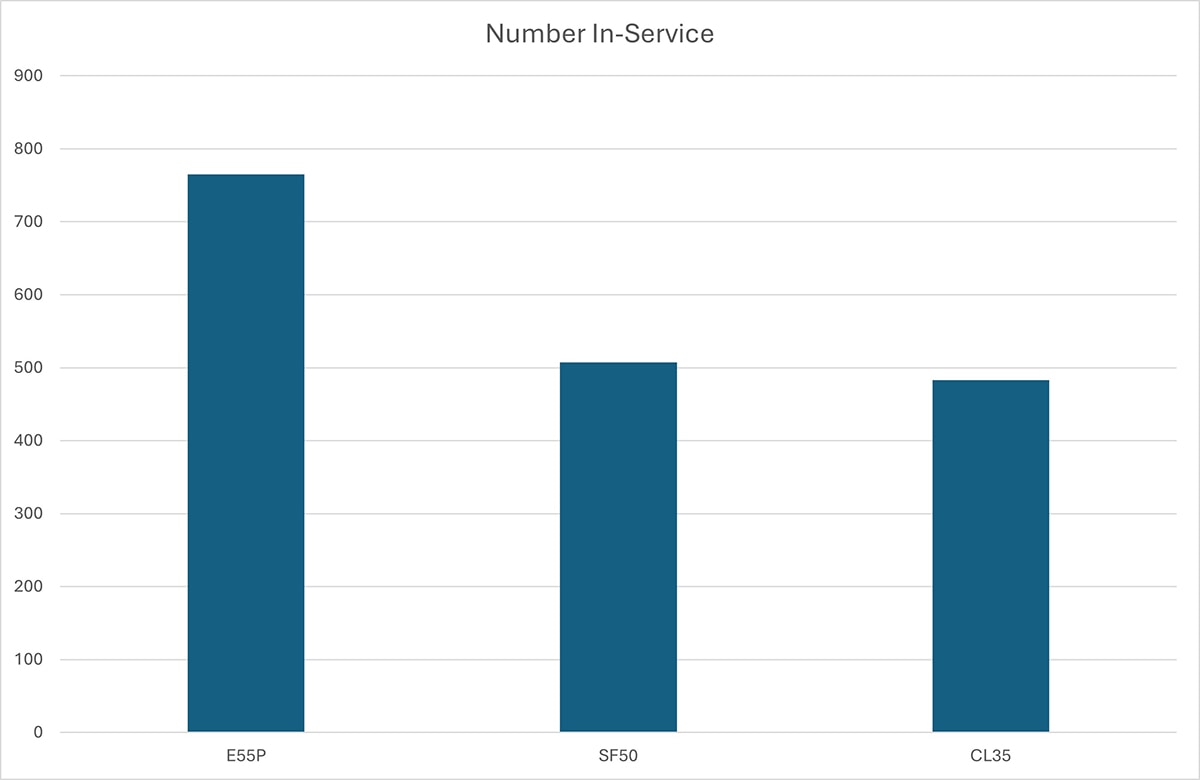

What if a similar grounding event, like the 737MAX, were to afflict the business jet sector, hypothetically impacting a leading-type variant, such as the SF50, E55P, and CL35? Well, these aircraft, without naming a make, model, or manufacture, represent the pinnacle of private aviation in terms of delivery volume and technological advancement over the past few years. They also serve as a backbone for many operations, ranging from charter services to over 400 airframes in fractional use. This scenario, while hypothetical, provides a valuable framework for analyzing the resilience and adaptability of the business aviation industry. Even in the face of challenges, what if… what if they just stopped flying?

Looking into Charter demand and market metrics:

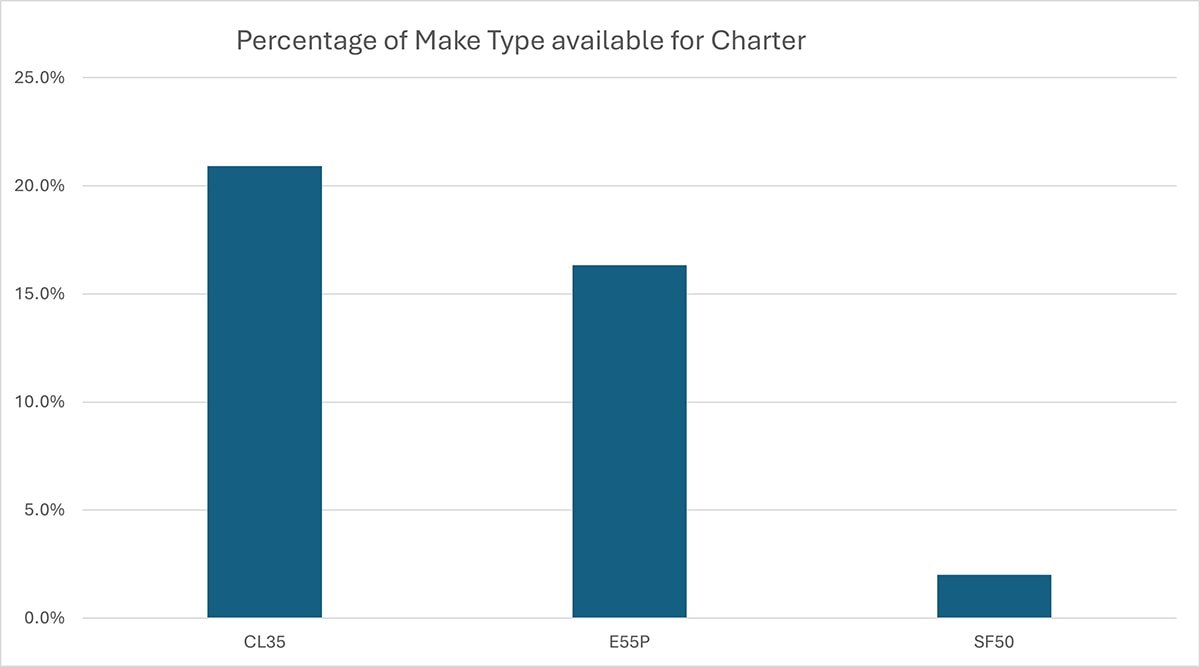

Well, the grounding of these key aircraft models in our industry would likely trigger a substantial shift in charter demand. As the SF50, E55P, and CL35 collectively constitute 7.3% of the in-service business jet fleet, their absence would create a noticeable vacuum. This scenario would force customers to seek alternatives, potentially driving up prices due to increased demand for the remaining available aircraft. Such a shift could have long-term effects on market dynamics as clients adjust their preferences and operators recalibrate their offerings to meet the changed landscape. One of my favorite metaphors is the principle of the hedonic treadmill, suggesting that once customers have experienced luxury and efficiency, their patterns will not change. In fact, for private flying, their expectations are permanently elevated, making them more sensitive to disruptions in their preferred mode of travel.

Operationally, our industry would need to improvise and overcome and adapt, as the grounding of these aircraft would pose significant challenges for operators. Maintaining service levels with a reduced fleet would require strategic resource allocation and management adjustments. Operators would need to reassess their practices, potentially seeking more versatile or readily available aircraft models to fulfill their obligations. The financial implications of having valuable assets grounded must also be considered, necessitating careful navigation of contractual commitments and potential compensation mechanisms. As I am sure readers know, aircraft parked on the ground are expensive lawn ornaments.

What can we learn from this?

As the saying goes, adversity [often] breeds innovation. The forced grounding of this hypothetical tranche of jets could catalyze business aviation to strengthen its commitment to safety, transparency, and operational excellence.

Drawing from the Boeing 737 MAX crisis, operators and manufacturers alike have an opportunity to enhance their safety protocols, invest in advanced training, and foster open communication with clients. This proactive approach not only aids in rebuilding trust but also positions the industry to withstand future challenges better.

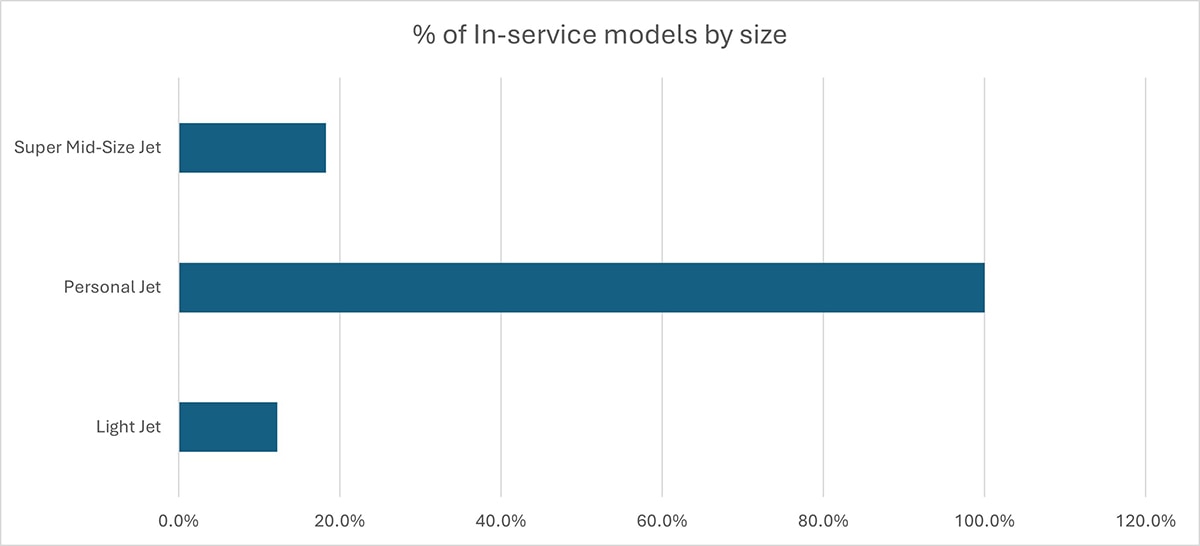

Referring back to the sample set shared earlier, these three models show and highlight the diversity within the business aviation fleet, ranging from personal jets like the SF50—often operated by single owners for business purposes—to light and super mid-size jets like the E55P and CL35, which play significant roles in the broader charter & fractional market. The reliance on these models by a varied clientele underscores the importance of maintaining a robust, flexible fleet capable of adapting to changing demands.

In conclusion, while the possibility of a grounding within the business aviation sector is far-fetched, it's not impossible. It’s always important to be vigilant. However, this acts as a poignant reminder of our industry's complexities and the critical need for continuous enhancement, vigilant monitoring, and a steadfast commitment to the core principles of safety and reliability. Thank you for navigating this hypothetical crisis while drawing lessons from past incidents to fortify the industry against future turbulence.

Sometimes, it’s helpful to ponder, what if…

Jason Lorraine

Assistant Vice President of Product Sales & Strategic Solutions

JETNET maintains the world’s most comprehensive and granular database of actionable business aviation information. Our ability to collect, analyze and disseminate highly relevant business aviation data is unmatched. Visit us at JETNET.com to learn how we can help you make better business decisions by leveraging the power of world-class data and unbiased market intelligence.