JETNET Blog

BRICS: From Emerging Markets to Economic Powerhouses - A Decade of Transformation

The past decade has seen the skies of business aviation redrawn, not just in North America but across the globe. From 2014 to 2024, business jets and turboprops have been influenced by a tapestry of economic, technological, and political factors, reflecting broader shifts in the global landscape. This article is not just about aircraft moving from one place to another; it’s about the reasons behind these migrations and the implications for the future.

With the BRICS 10 years ago, you could only go through a few news cycles without hearing the term mentioned. Where are they now? Brazil and China emerged relatively unscathed. Russia’s knock-on effects from the conflict with Ukraine are just starting to be seen and understood. India remains a highflyer in terms of economic growth and foreign investment, making it stand out. South Africa has been dealing with its own long Covid.

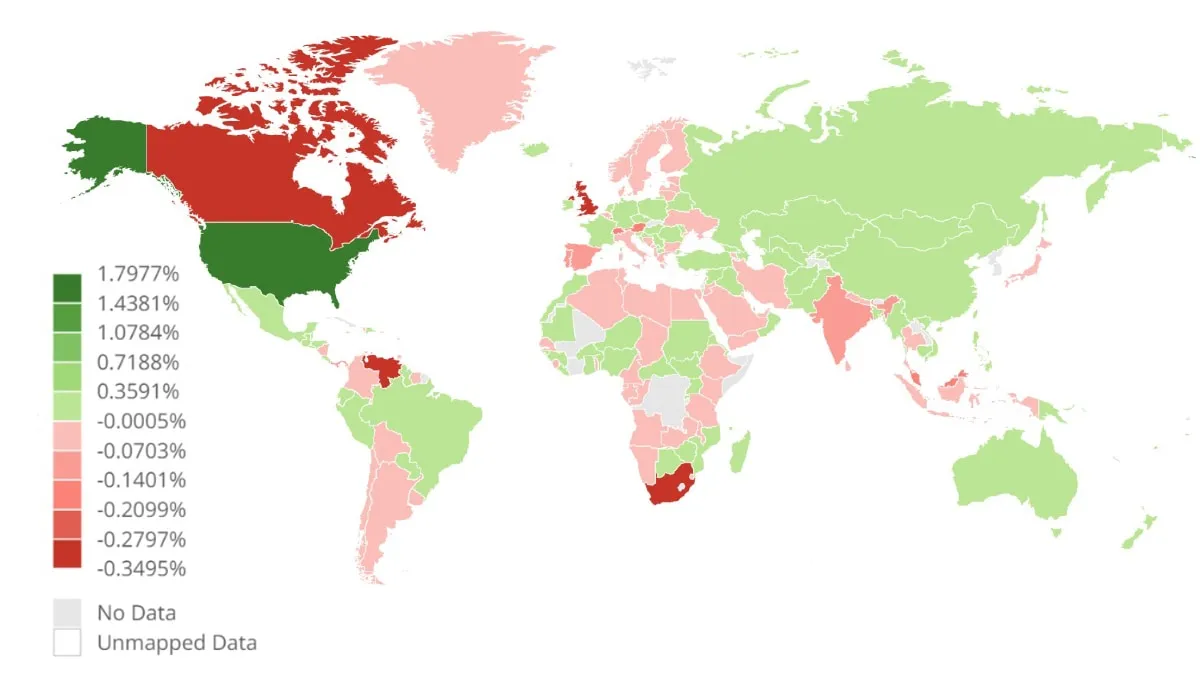

Worldwide Installed Fleet (in-operation) 2014-2024

Brazil: Soaring to Stability and Growth

After several years of recession, Brazil has been experiencing economic recovery. Post-recession recovery has stabilized its economy and created modest growth in recent years. They are combined with a large geographical area and limited alternatives for quick domestic transportation, making business aviation an attractive option.

Brazil’s fleet average age has increased by 4 years from seventeen years old in 2014 to twenty-one in 2024, suggesting a maturing fleet that could indicate a period of less aggressive investment in new aircraft or an increased reliance on existing aircraft for longer durations.

Russia: Turbulence Amidst Geopolitical Strains

The annexation of Crimea in 2014 and the subsequent conflicts that have followed have negatively impacted economic growth and, by extension, its business aviation sector.

Russia’s growth in the installed fleet was minimal, impacted by geopolitical tensions and economic sanctions that have somewhat stifled the potential expansion of its business aviation sector.

Russia’s fleet age increased by 5-years from an average fleet age of ten years old in 2014 to fifteen in 2024, pointing to a slower fleet renewal rate than Brazil and India. This increment could result from several factors, most notably the economic sanctions that may have limited the acquisition of newer aircraft.

India: High Flyers in a Growing Economy

India has maintained a relatively high economic growth rate compared to many other nations. The expanding business sector, increasing foreign direct investment, and a growing number of high-net-worth individuals contribute to the rising demand for business aviation.

India experienced a slight decrease in its installed fleet. Despite robust economic growth, regulatory challenges and infrastructure constraints may have contributed to this reduction.

With an average fleet age increase of 4-years from fourteen year old average fleet in 2014 to 18 years old in 2024, India’s business aviation sector shows a similar trend to Brazil, with aircraft being used over an extended lifespan. This could reflect steady market growth without significant turnovers for newer models or capital constraints in fleet expansion.

China: Navigating Regulatory and Economic Headwinds

China, on the other hand, has had two major blows to the growth of business aviation. The austerity measures that began in 2013 really kicked in the years that followed. Causing repatriation of aircraft to more favorable political and economic regions; the other major harbinger was the protracted closure of the border following Covid, with many insurmountable barriers to entry, simply conducting business with or in China very difficult. What will continue to hinder China’s growth will be regulatory, with the continued restrictions and a limited number of economical (think regular in RoW) routes available for civil aviation. Military still dominating the skies.

China saw an increase in its installed fleet, albeit small, which indicates resilience in the face of strict regulatory measures and a challenging political environment that has historically impacted the business aviation market.

The average age of China’s fleet increased by 6-years from an average fleet age of six years in 2014 to twelve year average age in 2024, tied for the largest increase with South Africa among the BRICS nations. This indicates a relatively more dynamic market with possibly better access to newer aircraft and a more aggressive fleet renewal strategy.

South Africa: Encountering Persistent Challenges

South Africa has been dealing with its own long COVID-19. Crime is growing, and some staples, such as water, need more supply, thus limiting outside investor confidence in the region. These issues have stifled the growth of its business aviation sector, which needs help attracting the necessary investment to expand and modernize in line with global peers.

These issues have stifled the growth of its business aviation sector, which needs help attracting the necessary investment to expand and modernize in line with global peers. The average age of South Africa’s fleet increased by 6-years from twenty-four years average age in 2014 to thirty year average age in 2024.

South Africa’s decrease in the installed fleet is significant, likely reflecting ongoing economic challenges, political instability, and issues such as crime and resource scarcity that affect investor confidence and operational feasibility in the business aviation sector.

Parting shots

Brazil’s journey towards stabilization and modest economic growth post-recession has seen a pragmatic adaptation in its aviation strategy, leveraging a maturing fleet amidst geographical and logistical constraints. Russia, grappling with geopolitical tensions and economic sanctions, shows a cautious aviation sector facing slow fleet renewal.

India’s story contrasts with robust economic strides and a burgeoning business sector, though tempered by regulatory hurdles that slightly reduce fleet growth. Meanwhile, despite severe regulatory and financial headwinds.

China demonstrates resilience in its aviation market, sustaining fleet growth against considerable odds.

South Africa’s scenario is the most strained, with socio-economic challenges severely impacting its aviation growth and resulting in a notable decrease in fleet size.

As we look towards the future, it’s clear that the landscape of business aviation within the BRICS countries will continue to evolve, influenced by each nation’s internal and external pressures. The adaptability and strategic decisions made now will undoubtedly shape their trajectories as economic powerhouses in the global arena. For industry stakeholders looking to stay ahead of these shifts, keeping an eye on JETNET’s comprehensive data is crucial. Our tools provide the insights needed to track these changes quicker, faster, and more accurately, allowing for strategic planning and decision-making that leverage emerging opportunities and navigate potential challenges.

At JETNET, we remain committed to providing industry-leading data and analysis that help stakeholders harness opportunities for growth and innovation in this dynamic global environment.

Average Manufacturing Year of Fleet

| Country | 2014 | 2024 |

|---|---|---|

| Brazil | 1997 | 2003 |

| India | 2000 | 2006 |

| Russia | 2004 | 2009 |

| China | 2008 | 2012 |

| South Africa | 1990 | 1994 |

Average Fleet Age (Years)

| Country | 2014 | 2024 |

|---|---|---|

| Brazil | 17 | 21 |

| India | 14 | 18 |

| Russia | 10 | 15 |

| China | 6 | 12 |

| South Africa | 24 | 30 |

Percentage Change in Worldwide Installed Base

| Country | 2014 → 2024 |

|---|---|

| China | 0.16% |

| Brazil | 0.13% |

| Russia | 0.06% |

| India | -0.10% |

| South Africa | -0.31% |

The US has the largest base, growing at (+1.8%) followed by Maldives (+.23%) China (+.16%) and Brazil (+.13%). The UK (-.30%), South Africa (-.31%), Canada (-.35%), and Venezuela (-.31%) are the countries with the largest reduction of their installed fleet.

Jason LorraineAssistant Vice President of Product Sales & Strategic Solutions

JETNET maintains the world’s most comprehensive and granular database of actionable business aviation information. Our ability to collect, analyze and disseminate highly relevant business aviation data is unmatched. Visit us at JETNET.com to learn how we can help you make better business decisions by leveraging the power of world-class data and unbiased market intelligence.

Take A

Test Flight

Get a personalized demonstration of the world’s premier aviation intelligence platform.