JETNET Blog

Trump 2.0 Should Give Green Light To Business Aviation

During the Friday–Sunday weekend prior to the inauguration of Trump (2.0) there were over 700 bizjet arrivals recorded into Washington DC airports, four times the number for the 3 days prior to President Biden’s inauguration in 2021. The arrival of the “broligarchy”, literally at the event and figuratively into power, appears to carry with it an endorsement of the business jet industry which characterizes the privilege and influence of its users. Trump’s first term was a friendly environment for business aviation, at least until Covid hit. So it’s no surprise to see the news of his second term reflected in very positive industry surveys.

Business aviation comes into 2025 with several years’ relatively strong performance. Aircraft sales thrived in the pre-owned market in 2021 and 2022 as the excess capacity of the previous decade got burnt off by the burgeoning demand of new users post-pandemic. This demand elevated aircraft pricing, and as inventory levels fell, orders for new aircraft surged. The last two years have seen recovery in OEM backlogs, with buyer interest galvanized by a slew of new aircraft models. Buoyed by pandemic-related quantitative-easing, the wealthy got a lot wealthier. Airline services—both schedules and reliability—generated markedly post-Covid, convincing a swathe of new users to use private jet charter.

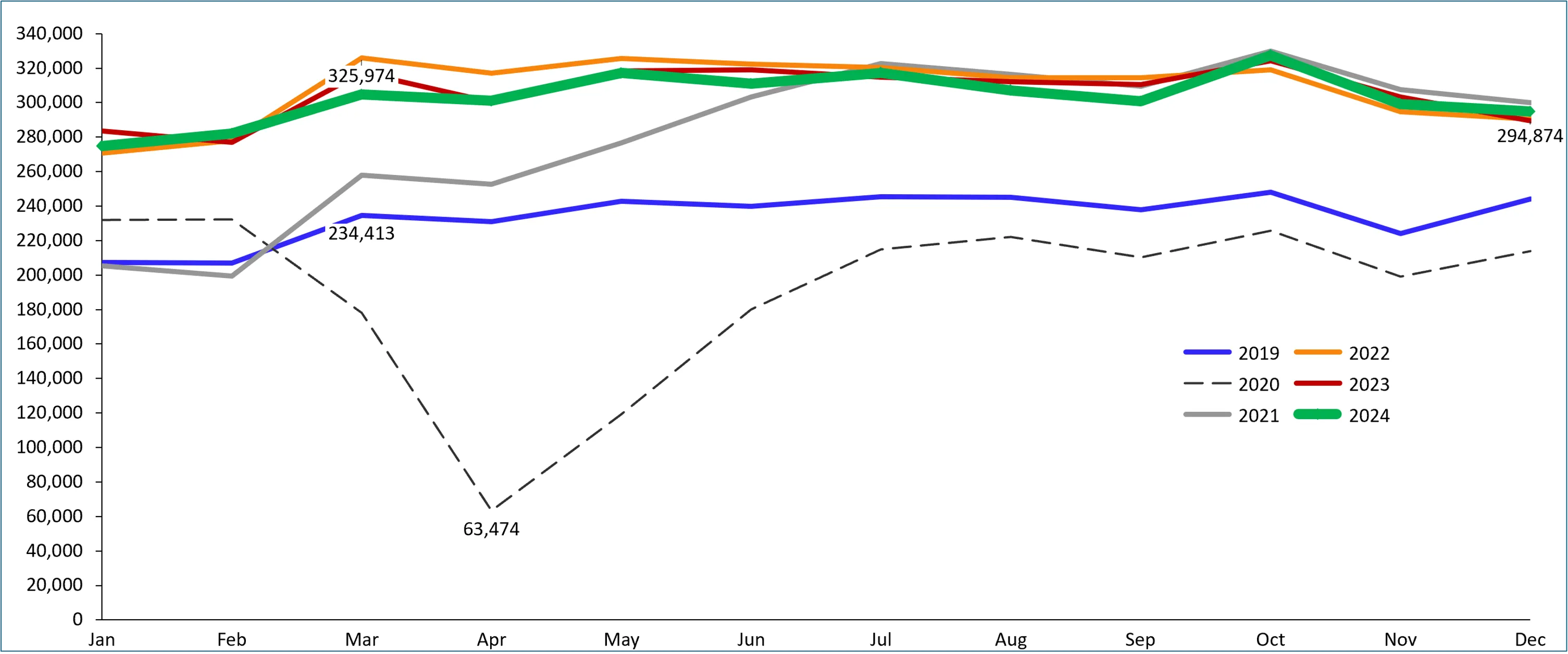

Chart 1: Global business jet departures since 2019

The industry’s last few years have not been without headwinds, however. Global supply chains have never recovered from the shocks induced by the pandemic. Distortions and shortages, across goods, services and human resources, were further embedded by the ramifications of wars in the Ukraine and the Middle East. High levels of spending and constrained supply lines unleashed a wave of inflation. The aviation industry, with its global operating span and eclectic need for technical skills and components, has been particularly affected. Slower, more complicated production lines have limited the OEMs’ response to increased demand for product. Bizjet deliveries are barely recovered to 2019 levels, still far behind the numbers we saw almost two decades ago.

Aircraft utilization has also wavered in the last 12 months, falling back on 2023, which itself had deflated compared to the post-Covid peak in 2022. The environment for flying private had chilled. Expectations of a hard landing for the US economy were relatively high at the start of last year, as interest rates stayed higher for longer to battle stubborn inflation. The industry’s new entrants to the charter market hesitated as pricing soared and service levels dropped off. The Biden administration specifically favored more regulation and tax for business jet owners. Environmental concerns got the limelight, framing business jet users as emissions culprits.

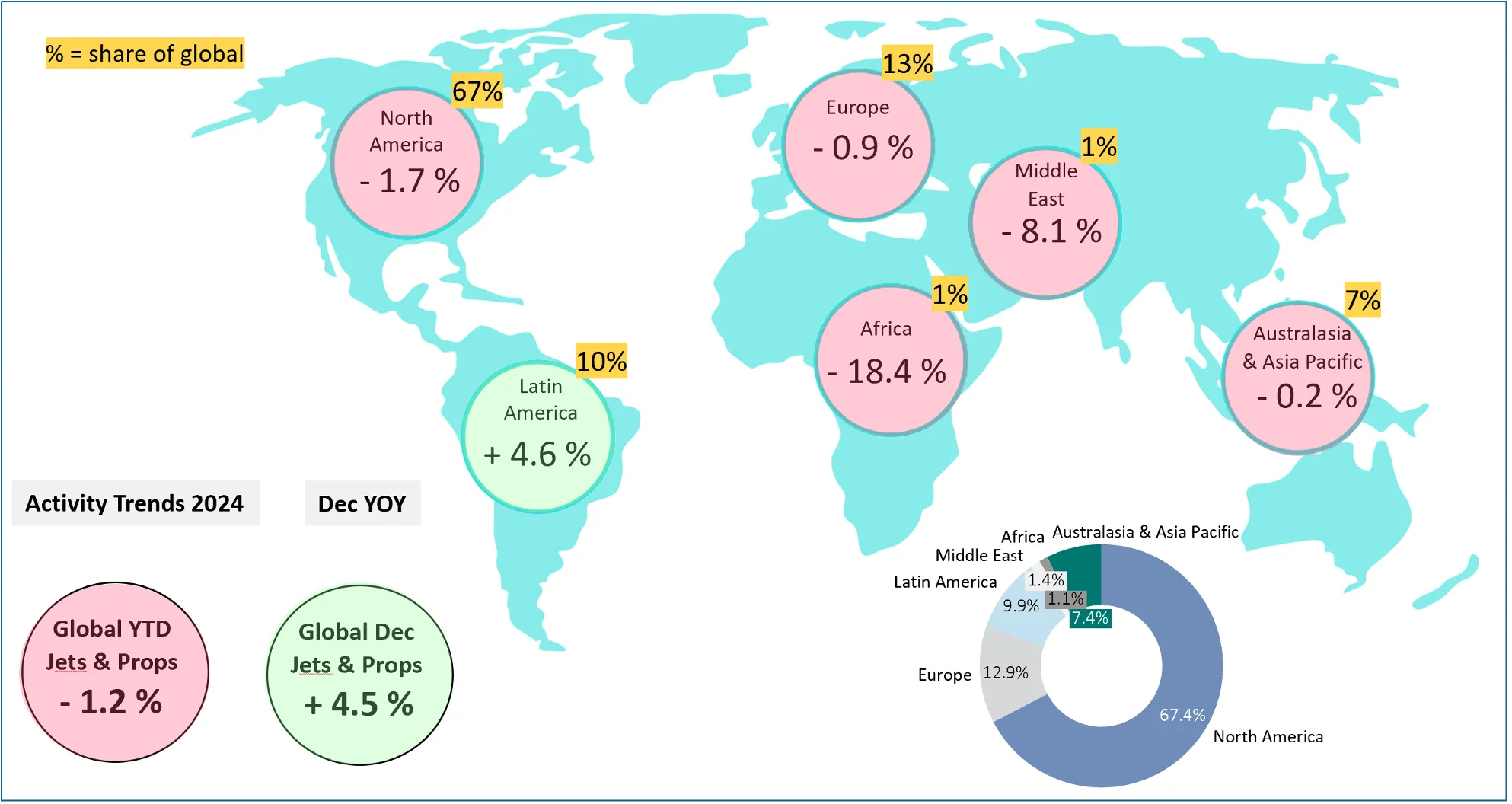

Outside the core North American market—which supports well over two-thirds of bizjet flight activity—the industry’s prospects have been dimmed by an array of overlapping geopolitical crises. Europe has endured almost three years of the Ukraine war on its border, removing the Russian business jet market, and more broadly undermining European economies through trade disruption and energy insecurity. War in the Middle East has stalled the investment needed to meet pent-up demand for business jets services. In Africa, widespread political instability continues to subdue business jet services. Asia should be a vast market for the industry but the opportunity is imperiled by growing Sino-US tensions. South America is the one region which saw solid growth in bizjet and turboprop flight activity last year.

Chart 2: Business jet activity and YOY trends by region in 2024

Even the most ardent Trump supporters do not expect this Administration to find solutions across these many geopolitical hotspots. But the clear intention to find deals and fixes could freeze conflicts and lower tensions. If and where it works, this could clear the way for doing business, much as the way the Abraham Accords of his first term encouraged tourism and development in the Gulf. On the other hand, too much US isolation could encourage rather than simmer conflicts. Add to this Trump’s avowed intent to impose tariffs on the US’ major trading partners, and we may see echoes of the isolationist and protectionist US government in the late 1920s, which didn’t end well. Even in the short term, tariffs, if fully implemented, are likely to rebound as inflation on the US economy.

The pro-business policy outlook expected of Trump 2.0 is a tangible catalyst for business aviation, at least as far as the US is concerned. Cutting back on government spending, prioritizing deregulation, deprioritizing the green agenda, reenabling oil and gas production, and reducing taxes all augur well for doing deals in the US in 2025. The dollar has surged in value since his election—cheapening the purchase of overseas aircraft for US buyers—and even since his inauguration, bond yields have fallen and stocks are up. M&A activity in the US has been subdued since 2022, but since Trump won the election, corporate surveys suggest that activity will rebound this year. Roadshows and acquisitions go hand in hand with bizjet demand in the US.

There is however a fundamental tension within Trump’s 2.0 project, which is that much of the MAGA vision runs counter to the instincts of entrepreneurial corporate America. Hints of a clash to come were evident in the rows over H1B immigration visas. Immigration has veered wildly out of control in the US but the two poles of Trump’s constituency aren’t agreed on how to manage it. Likewise his tariff policy may see a clash of interests between protectionism and free trade. The coalition of corporate America and working class MAGA was sufficient to gain the White House but will likely soon fall foul of internal contradictions. With the mid-terms only 18 months away and only a narrow majority in the House, Trump’s mandate could be circumscribed quite quickly.

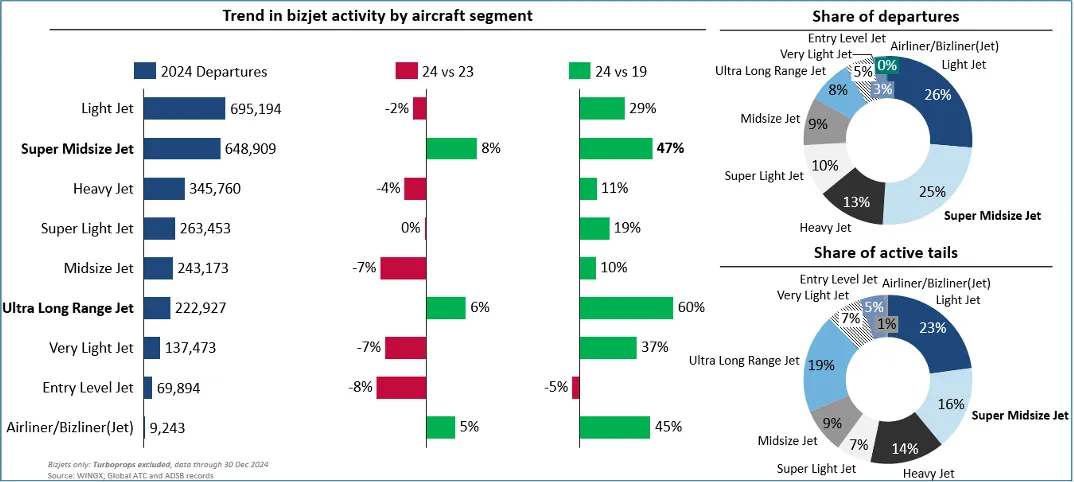

In the short term, at least in the next 6 months of 2025, Trump’s election is undeniably catalyzing a surge in bizjet traffic. The turning point is very obviously the election in late Q4, with a rebound at the end of the year which has seen several weeks’ growth of more than 10% in YOY flight activity, after a year of standstill annual trends. Anecdotally, aircraft brokers are busier than ever. The strongest interest is in midsize and large cabin, also reflected in relatively stronger utilization for these categories versus smaller aircraft, for which movements fell 2% last year. Entry-level and Very Light Jet segment activity fell as much as 10%, with the overall small cabin category bolstered due to a few highly demanded models such as the Cirrus Jet and Phenom 300.

Chart 3: Business jet activity by Cabin segment

Uncertainty and still some economic fragility in the months ahead will likely continue to affect demand for lighter aircraft classes, whose customers and owners have lower spending thresholds and more limited investment horizons. In contrast, Super midsize and Ultra Long Range jet activity hit new highs in 2024, with more than 40% increase in flights compared to pre-pandemic. The Embraer Praetors, Citation Latitudes and Challenger 300 platforms have very effectively responded to the mission needs of the burgeoning North American charter and fractional market. In the largest cabin classes, the delayed G700 has sharpened competition at the top end, with the entry into service of Falcon 10X, Gulfstream 800 and the Global 8000 in 2025 likely to galvanize flight activity.

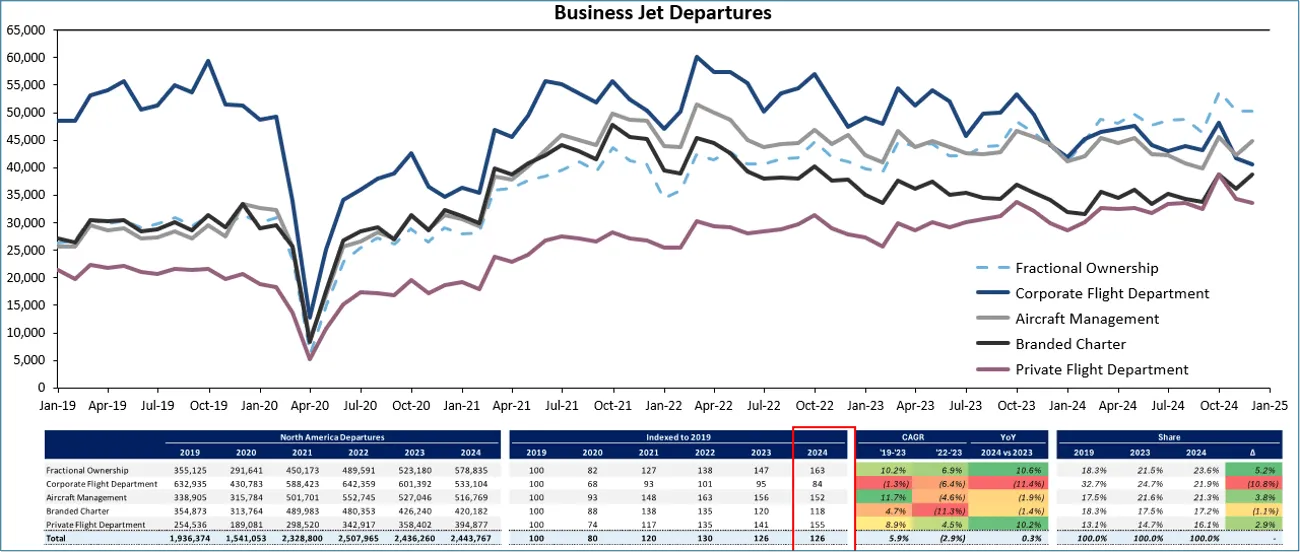

The flatline trend in activity in North America in 2024 belied a wide variety of trends across different operator types. Private Flight Departments saw a surge in fleet size to accommodate many first-time aircraft owners, lifting private flights by 10% last year. In contrast, Corporate Flight Departments, with more than 5,000 active aircraft representing the largest fleet by operator type, have seen a sizable reduction in activity. Branded charter operations surged post-Covid then receded as inflated prices and unreliable service levels lost them customers. The big winner has been the Fractional Operator, representing less than 10% of the active fleet but 25% of activity, with sectors increasing 10% in 2024 compared to 2023, and by more than 60% compared to 2019.

Chart 4: Business Jet Activity by Operator Type

One of the primary reasons for the surge in fractional customers is the long lead time for new aircraft deliveries, at least two years for the newest long-range jets. In an ideal world for the industry, once the OEMs get their production lines to meet pent-up demand for aircraft, the fractional customer base will step up to full ownership, multiplying demand for new aircraft. An alternative scenario may be that the successful growth of fractional programs actually limit aircraft sales, as customers decide to forgo the cost and headache of full ownership. Conversely, in the US, the restoration of 100% depreciation treatment could boost the attractiveness of ownership. Likewise, the government’s demotion of the green agenda could restore corporate willingness to fly private.

For twenty years, the business aviation industry has been expecting the US-centric market to evolve across other regions. After all, even then the US share of the world’s wealthy population was far lower than its share of business jets. The shift seemed in play following the Global Financial Crisis in 2008 when US demand for bizjets receded, and BRIC countries emerged as potential peer economies. Since then, Brazil has established itself as a leading market, but Russia, India, and China are still minnows in terms of bizjet markets, despite having ever greater numbers of ultra wealthy individuals. No doubt 2025 will see strong growth in some secondary markets, not least India, also the Gulf markets. But Trump 2.0 is likely to take the US business jet market back to its most dominant geographical status of the last 20 years.

Richard KoeManaging Director, WINGX

JETNET maintains the world’s most comprehensive and granular database of actionable business aviation information. Our ability to collect, analyze and disseminate highly relevant business aviation data is unmatched. Visit us at JETNET.com to learn how we can help you make better business decisions by leveraging the power of world-class data and unbiased market intelligence.

Take A

Test Flight

Get a personalized demonstration of the world’s premier aviation intelligence platform.