JETNET Blog

JETNET Reviews 2024 Pre-Owned Business Aircraft Market Performance

The 2024 pre-owned business aircraft market saw notable shifts in inventory, pricing, and sales performance. JETNET’s latest review provides an in-depth analysis of these trends, offering key insights into how the market has adjusted post-pandemic. Below is a breakdown of the most significant developments.

Inventory Trends

-

Business jet inventory increased by 24% from 1,622 units in January to a peak of 2,016 units in November, correcting to 1,851 units at the close of December (7.4% of fleet).

-

Business turboprop inventory rose by 22%, reaching 822 units in November before settling at 779 units in December (4.5% of fleet).

-

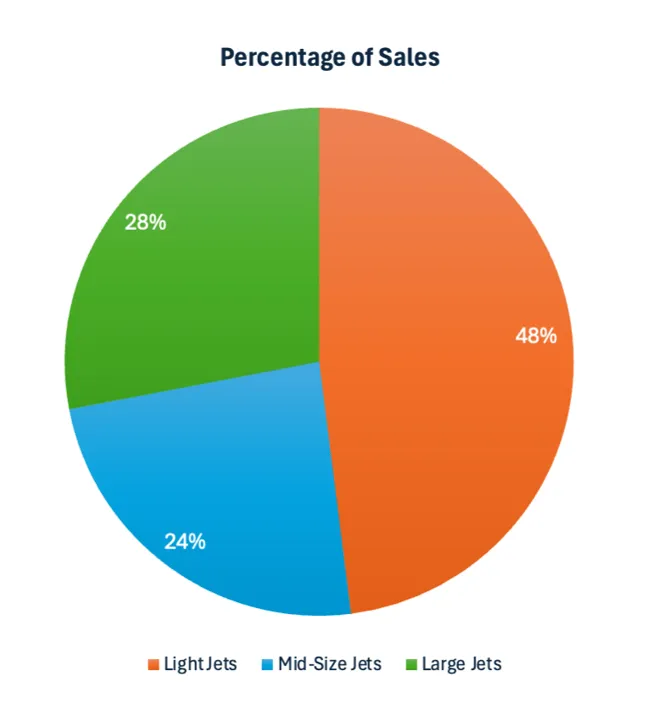

The distribution of jet inventory remained relatively stable throughout the year:

- 48% Light Jets

- 24% Mid-Size Jets

- 28% Large Jets

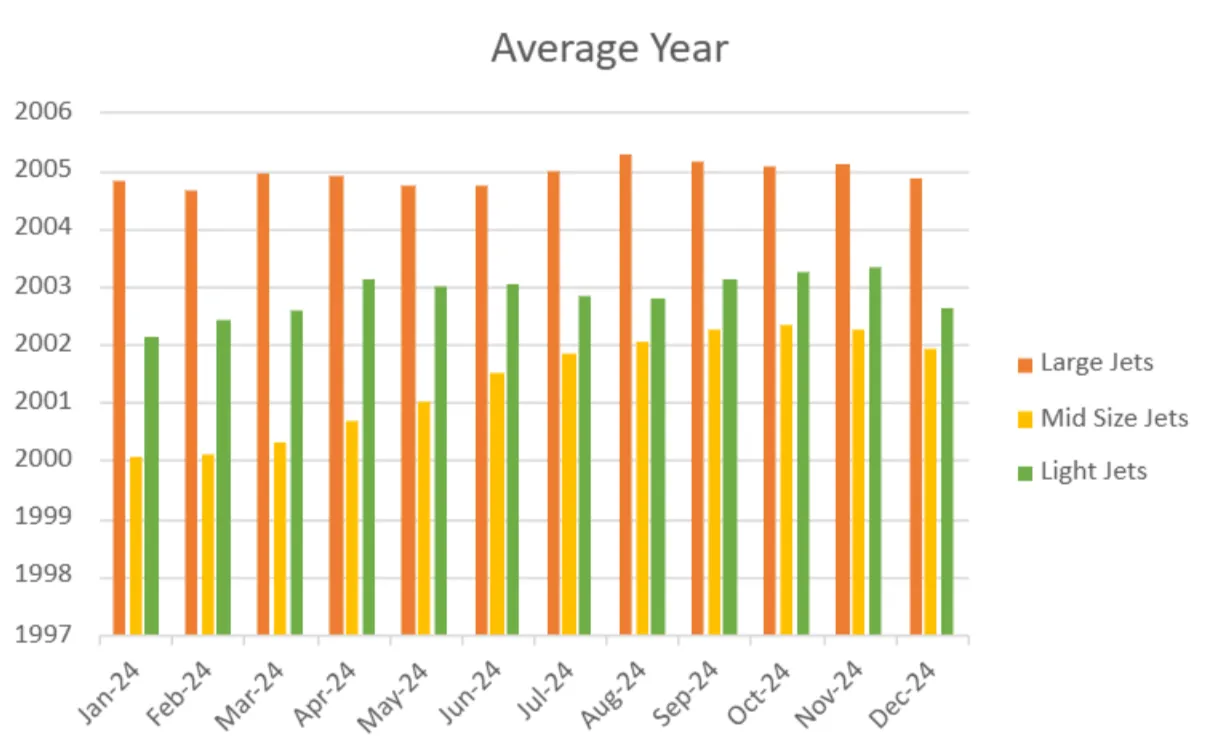

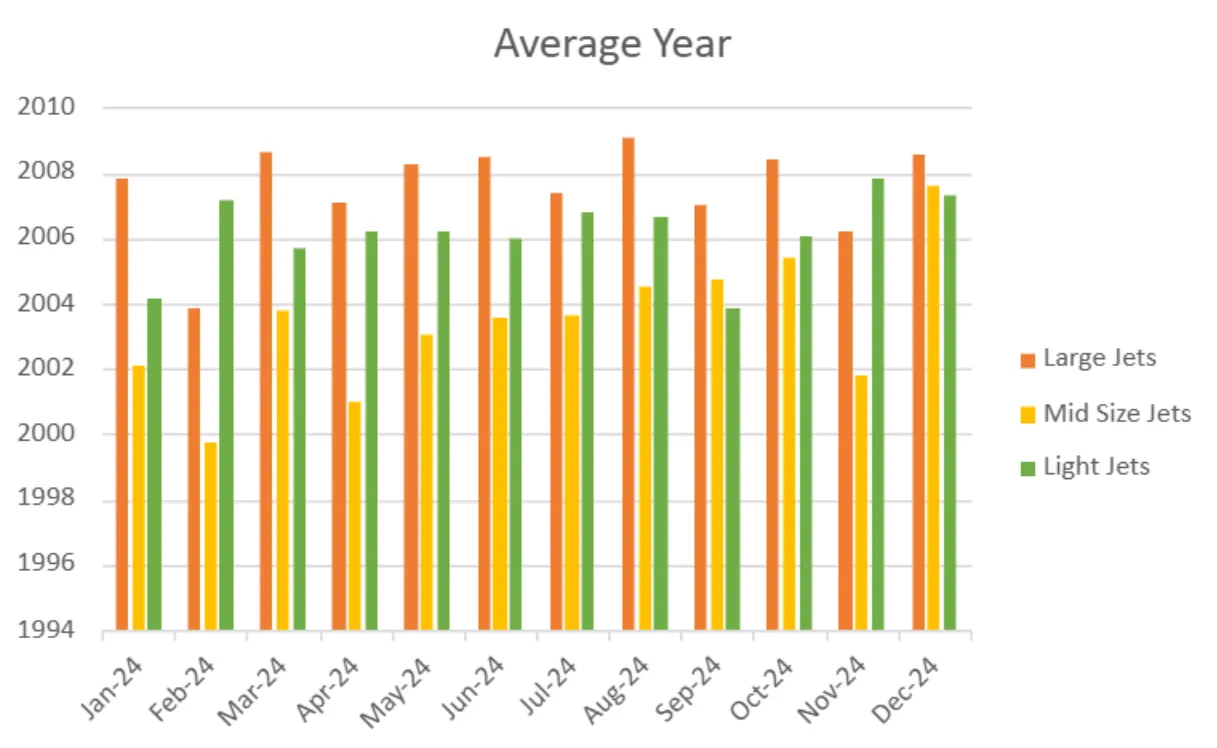

Age Trends of Aircraft On Market

- Light jets: Steady at an average age of 22 years (2002 model).

- Mid-size jets: trended younger from 24 years to 22 years (2002 model).

- Large jets: steady at about 20 years old (2004 model).

- The inventory for sale of all business jets averaged 21 years old (a 2003 model) while business turboprops averaged 26 years old (a 1998 model).

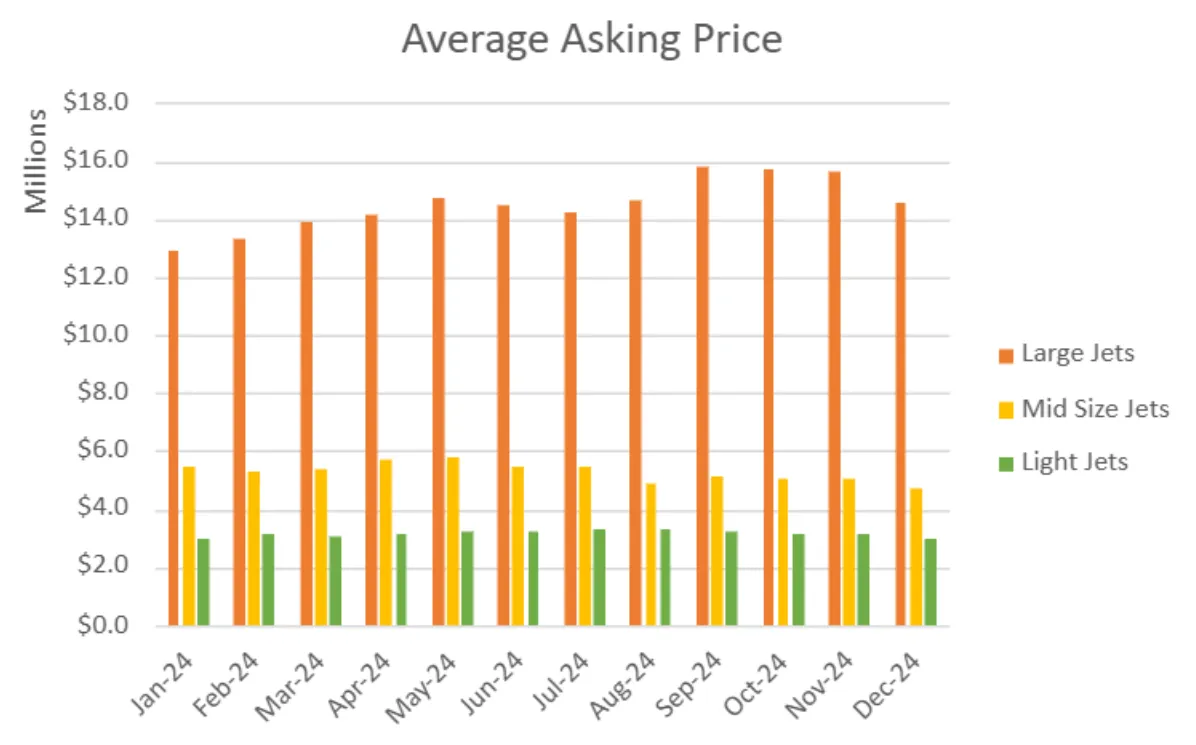

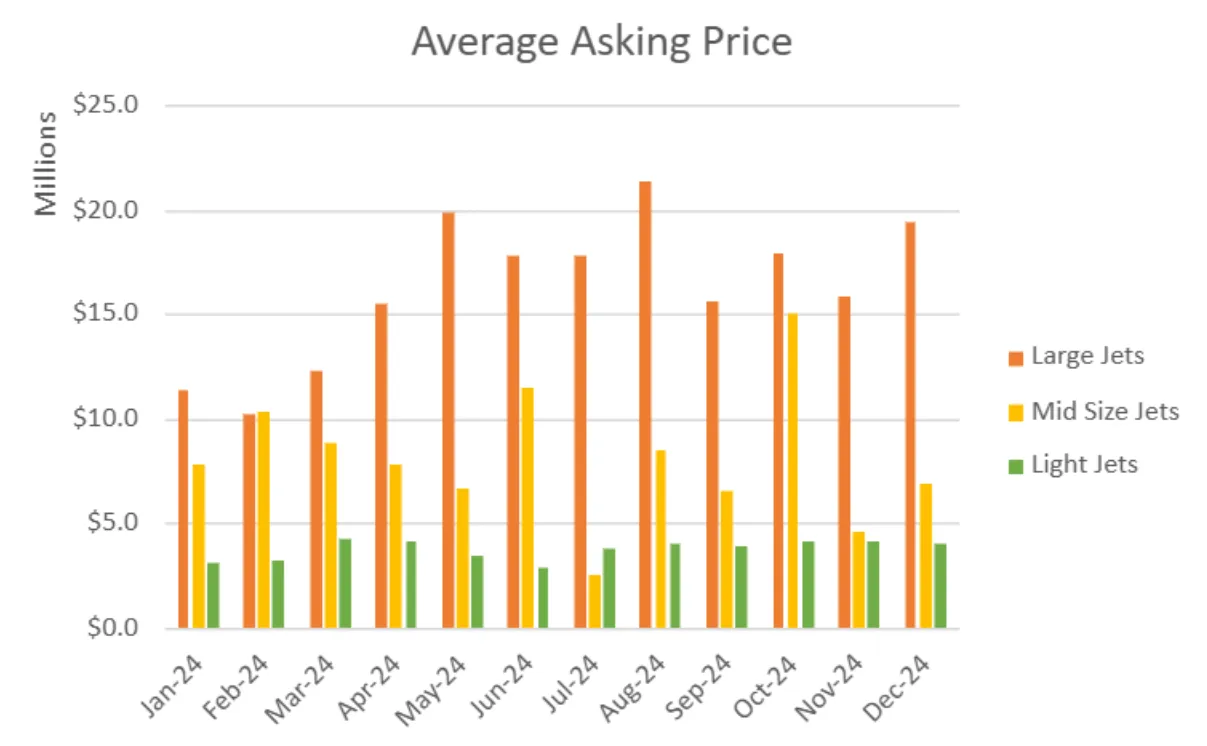

Pricing Insights (Asking Prices)

- Light jets: Held steady at $3.0M.

- Mid-size jets: Declined 13%, from $5.4M to $4.7M in the second half of 2024.

- Large jets: Strengthened 11%, increasing from $13.3M to $14.7M.

- All business jets: Average asking price increased from $6.2M to $6.5M (4.8%).

- All business turboprops: Declined 1.9%, from $2.195M to $2.153M.

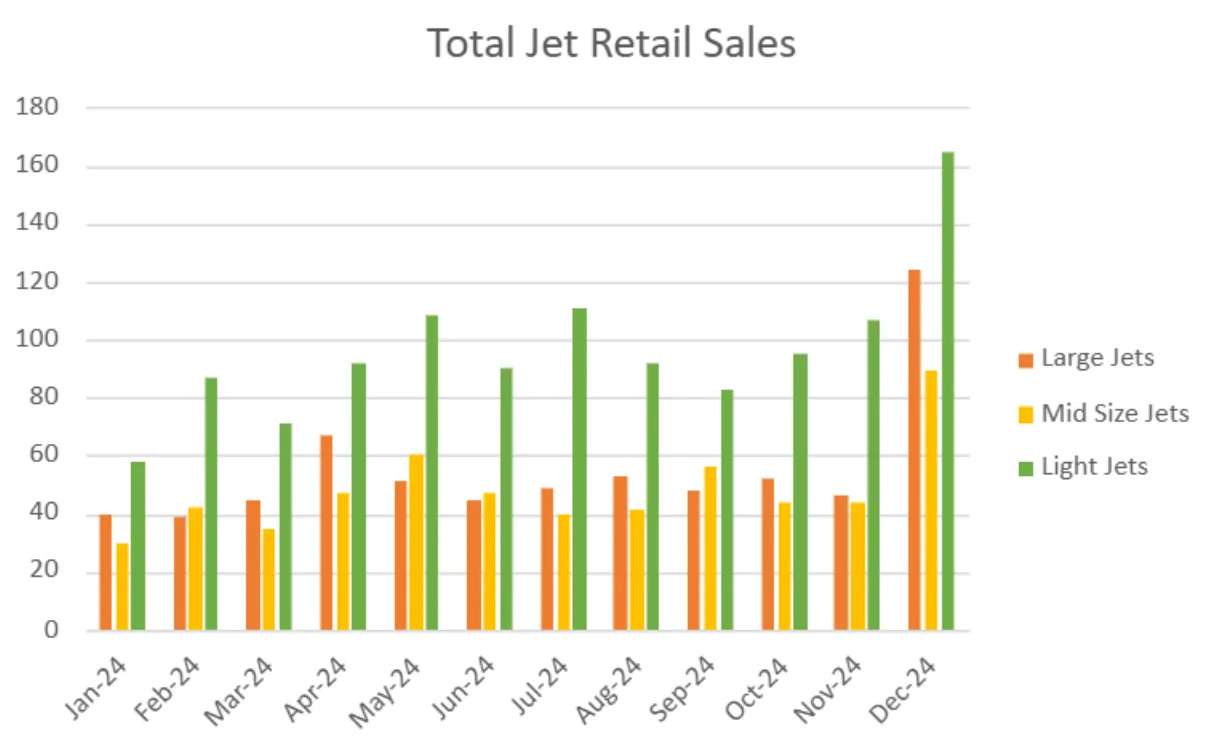

Sales Performance

-

Total business jet sales in 2024: 2,309 units (down 4.2% from 2023’s 2,410 units).

-

Monthly average: 192 sales per month, with Q4 accounting for 33% of total sales (759 units sold between October and December).

-

Aggregate Age of Aircraft Transacted in 2024

- Light jets: 2006 model (18 years old, 4 years newer than the inventory average).

- Mid-size jets: 2005 model (19 years old, 3 years newer than inventory average).

- Large jets: 2009 model (15 years old, 5 years newer than the inventory average).

-

Business turboprop sales: 1,168 units sold in 2024, with an average age of 23 years (2001 model).

-

Average asking prices of aircraft sold:

- Light jets: $4M (vs. inventory average of $3.0M)

- Mid-size jets: $6M (vs. inventory average in the low $5M range)

- Large jets: $17.5M (vs. inventory average of $14.7M)

- Business turboprops: $2.34M (vs. inventory average of $2.153M)

Key Market Insights

- Buyers prefer newer aircraft models with lower total flight hours and enrolled in engine programs, particularly in the large jet segment.

- The average sales cycle has shortened since pre-pandemic 2019. In 2024, jets averaged 207 days to sell, down from 249 in 2019. Turboprops are averaging 190 days, down from 279, signaling strong demand for well-maintained aircraft.

- Post-pandemic market corrections are stabilizing as inventory normalizes and pricing trends adjust.

Paul Cardarelli, JETNET’s Vice President of Sales, commented: “Our 2024 review confirms that the market is adjusting post-pandemic while continuing to present opportunities for sellers, particularly in the large cabin segment where demand remains strong for newer, well-maintained aircraft.”

Discover how JETNET’s comprehensive array of research-led tools and data solutions can empower your aviation business with actionable intelligence.

Request DemoPaul Cardarelli

Vice President of Sales, JETNET

JETNET maintains the world’s most comprehensive and granular database of actionable business aviation information. Our ability to collect, analyze and disseminate highly relevant business aviation data is unmatched. Visit us at JETNET.com to learn how we can help you make better business decisions by leveraging the power of world-class data and unbiased market intelligence.

Take A

Test Flight

Get a personalized demonstration of the world’s premier aviation intelligence platform.